India’s Richest Man Accused of Pulling the ‘Largest Con in Corporate History’

After an activist investment firm published a report on Tuesday accusing his company, Adani Group, of "brazen" stock manipulation and accounting fraud worth $218 billion, billionaire Gautam Adani fell from being the third richest man in the world to the seventh position, wiping $27.9 billion from his personal net worth since the beginning of the year.

Using U.S.-traded bonds and non-Indian-traded derivative instruments, Hindenburg Research, which has previously shorted—or gambled against—businesses like Twitter and electric truck manufacturer Nikola Corp, said it holds short holdings in Adani companies.

The study released on Tuesday caused the stock of the flagship firm and affiliates of the Adani Group to plunge, suffering a loss of more than $50 billion since then, and compelled the corporation to strongly deny its contents.

The following information regarding Adani and the charges of corporate wrongdoing.

Who is Gautam Adani?

India's richest individual and self-made billionaire, Gautam Adani, with a net worth of about $118 billion as of April 2022. The share prices of his major publicly traded firms increased throughout the past three years, propelling the billionaire to the third-richest man in the world behind Elon Musk and Jeff Bezos. A large portion of this fortune was gained during this time through his company Adani Group.

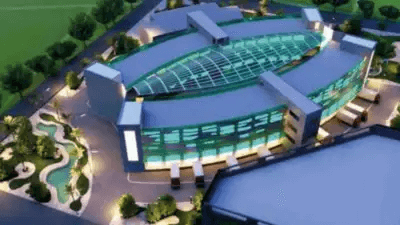

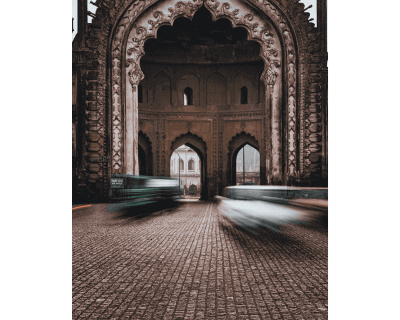

The industrialist began as a commodity dealer in the 1980s before he innovated his company Adani Group in 1988, ultimately expanding it into a private structure conglomerate that operates anchorages, airfields, and coal mines across India and the world. The group also has multiple accessories through its data and string centers and the manufacturing of defense goods. It plans to expand further through a$ 70 billion investment in green energy businesses in the coming time.

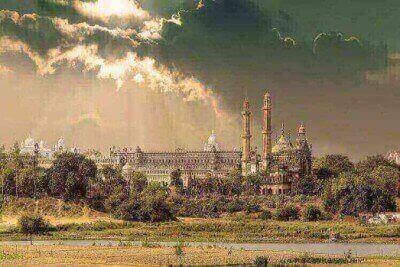

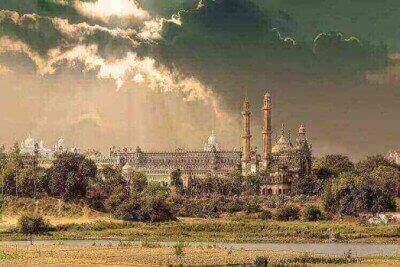

The company’s success has frequently been linked to economic government concessions, thanks to Adani’s close ties with India’s ruling Bharatiya Janata Party. In the history, Adani has been a oral supporter of Prime Minister Narendra Modi’s vision for a “ tone- reliant India. ”

What do Hindenburg’s findings reveal?

Among different allegations, the file says that Adani Group engaged in inventory charge manipulation and accounting fraud over the route of decades, and located proof that the organization`s “7 key indexed agencies have 85% disadvantage simply on a essential foundation attributable to sky-excessive valuations.” It additionally stated that significant debt places the organization on “precarious economic footing.”

The file names numerous own circle of relatives individuals—like Gautam Adani`s brothers, Rajesh and Vinod Adani, in addition to friends of the Adani Group—for his or her involvement in essential bribery and tax evasion cases. Members of the Adani own circle of relatives had been the topics of beyond corruption investigations done with the aid of using the Securities and Exchange Board of India (SEBI) and the Directorate of Review Intelligence. The Hindenburg file additionally claims that Adani own circle of relatives individuals allegedly cooperated withinside the introduction of offshore shell entities worth $4.five billion thru solid documents, generally in tax-haven jurisdictions like Mauritius, the UAE, and the Caribbean islands. Hindenburg stated that SEBI became nevertheless investigating a case in Mauritius in September 2022, however that no motion has been taken in opposition to the organization so far.

Hindenburg said the report’s findings were grounded on interviews with dozens of individualities, including former elderly directors at Adani Group, thousands of documents, and due industriousness point visits in nearly half a dozen countries.

How has the Adani Group responded to the allegations?

Adani Group’s principal fiscal officer Jugeshinder Singh said in an sanctioned statement Wednesday that the company was shocked by the report, calling it a “ vicious combination of picky misinformation and banal, unwarranted, and discredited allegations. ”

Adani Group didn't address specific allegations in its sanctioned statement but said it has always been in compliance with the law. The empire also said that the timing of the report suggested vicious intent to “ undermine the Adani Group’s character with the top ideal of damaging the forthcoming follow- on Public Offering from Adani Enterprises, ” pertaining to the group’s plans for adding the quantum of freely traded shares.

On Thursday, Adani Group said in a new statement that it's considering legal action against Hindenburg. “ We're assessing the applicable vittles under US and Indian laws for remedial and corrective action against Hindenburg Research, ” said Adani Group Legal Head Jatin Jalundhwala. He added that the report created “ volatility in Indian stock requests ” that was “ of great concern and has led to unwanted anguish for Indian citizens. ”

Hindenburg has dared Adani Group to sue, saying it would open the company to foster scrutiny.

The report was published days before bidding for a$2.5 billion stock trade for Adani’s secondary shares begins Friday, which will include anchor investors like the Abu Dhabi Investment Authority and Morgan Stanley.

One investor told the Financial Times they're “ apprehensive ” of Hindenburg’s report and are “ taking it into consideration.